The EV revolution is surging, with over 17 million new EVs hitting global roads in 2024, marking an impressive 25% annual increase. However, a new in-depth survey commissioned by Driivz, a leading global software provider for EV charging operators, has pinpointed critical roadblocks hindering the necessary infrastructure growth. The findings reveal that EV charging network operators are overwhelmingly concerned about grid capacity limitations and network scalability as they strategize for 2025 and beyond.

This crucial survey, designed to dissect the core challenges and priorities within the rapidly evolving EV charging industry, highlights the significant obstacles operators are currently confronting. It also examines their preparedness to manage the anticipated explosion in EV charging demand and their planned approaches to deliver a seamless experience for EV drivers. The resulting report offers invaluable insights for all stakeholders – from independent charging providers to utilities and automotive OEMs – aiming to establish and maintain successful EV charging networks.

Key Takeaways: Unpacking the Pressing Issues

Grid Capacity Crunch: The Number One Hurdle

Energy constraints at EV charging sites are the paramount challenge, cited by a significant 46% of surveyed operators. Worryingly, over 90% anticipate grid capacity will impede their expansion within the next year. This energy bottleneck directly threatens the ability to scale operations, a reality already impacting growth in markets like the Netherlands and the U.S. due to existing grid congestion.

Scalability at a Standstill: A Major Industry Worry

A substantial 80% of network operators express apprehension about their network scalability, rating their current capacity as only minimal or moderate. Drilling down further, platform limitations are also a concern, with 45-61% reporting minimal or moderate scalability across vital functions like charger management, driver support, transaction processing, and roaming partnerships. This “scalability wall” presents a significant risk to future growth as EV adoption accelerates.

User Experience Optimization Takes Investment Priority

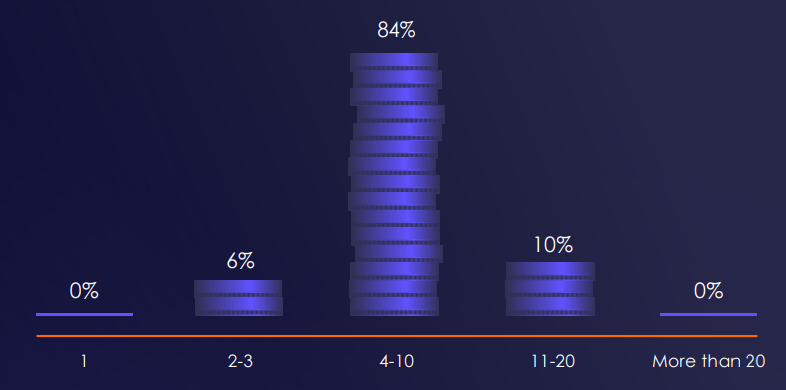

When asked about their top investment focus for enhancing the EV charging experience in 2025, 33% of operators prioritized optimizing operations. Following closely were differentiating pricing models (29%) and expanding public charging sites (29%), alongside increasing the deployment of fast chargers (25%). While direct investments in driver-facing aspects ranked lower, the emphasis on operational efficiency and network stability is viewed as a fundamental pathway to improved user satisfaction and EV driver retention.

Compatibility Challenges Still Frustrate Drivers

Despite established standards, charger compatibility issues remain a significant pain point for EV drivers. Vehicle-specific compatibility problems were the leading cause of failed charging sessions (45%), with nearly 40% also citing OCPP compliance issues with chargers. Adherence to crucial standards like OCPP and ISO 15118 is essential for seamless interoperability and unlocking advanced charging functionalities.

Grid Capacity: A Universal Obstacle to EV Charging Expansion

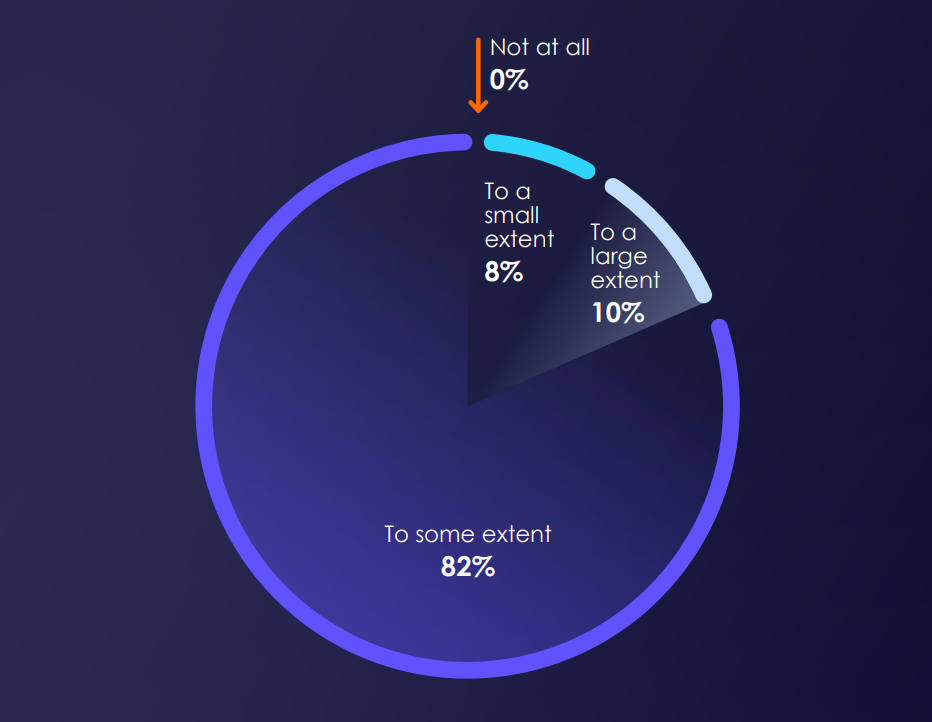

The survey underscores the pervasive concern surrounding grid capacity, with a full 100% of respondents anticipating it will impact their expansion plans in the coming year. While most (82%) foresee a moderate impact, a notable 10% expect significant hindrances. This reinforces the urgency of addressing energy constraints to facilitate the necessary growth of EV charging infrastructure in regions like North America and Europe.

Battery Storage Emerges as a Key Solution for EV Charging Operators

To navigate grid capacity limitations, EV charging operators are increasingly turning to local battery storage. The survey reveals that 17% currently utilize this technology, with a significant 73% planning implementation within the next 12 months. This growing adoption highlights the recognition of battery storage as a critical tool for supplementing grid power, enhancing the reliability of EV charging sites, and mitigating the costs associated with peak-hour electricity consumption.

Revenue Model Flexibility: A Future Imperative for EV Charging Networks

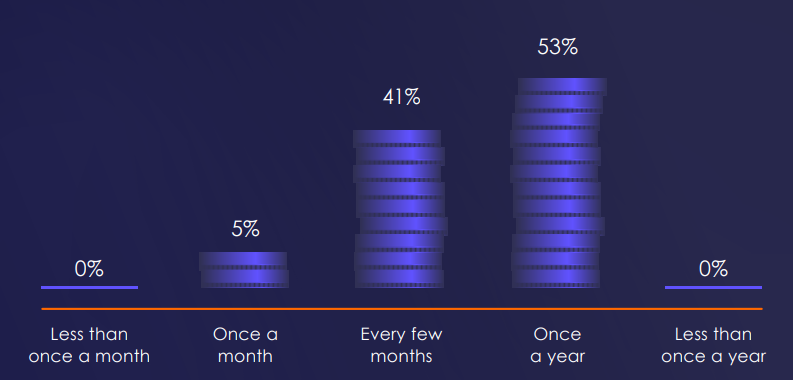

The survey indicates a current stability in EV charging revenue models, with most operators using a limited range and updating them infrequently. However, the report suggests that as the industry matures, greater flexibility in revenue parameters, facilitated by robust platforms supporting roaming integrations and a wide variety of charger models, will be crucial for sustained competitiveness and growth.

Conclusion: Addressing Bottlenecks to Power the EV Charging Future

The Driivz survey delivers a clear message: grid capacity and network scalability represent significant hurdles for the EV charging industry. While the path to profitability may be emerging for some operators in 2025, these fundamental infrastructure challenges must be addressed to ensure the continued growth and widespread adoption of electric vehicles. Smart energy management and the strategic deployment of local battery storage offer promising pathways to alleviate energy constraints. Looking ahead, prioritizing platform scalability, charger compatibility, and flexible business models will be essential for EV charging network operators to thrive in this rapidly evolving market and deliver the seamless charging experiences that EV drivers demand.

Note: The survey, conducted in Q1 2025, gathered insights from 300 key decision-makers within the EV charging industry across North America and Europe.

To access the full report, visit www.driivz.com or check it here .