The following article is based on a report from GetFocus titled “Europe’s EV Wake-Up Call: Rethinking Strategy to Compete with US and China.”

The Genesis of Europe’s Strategic Miscalculations

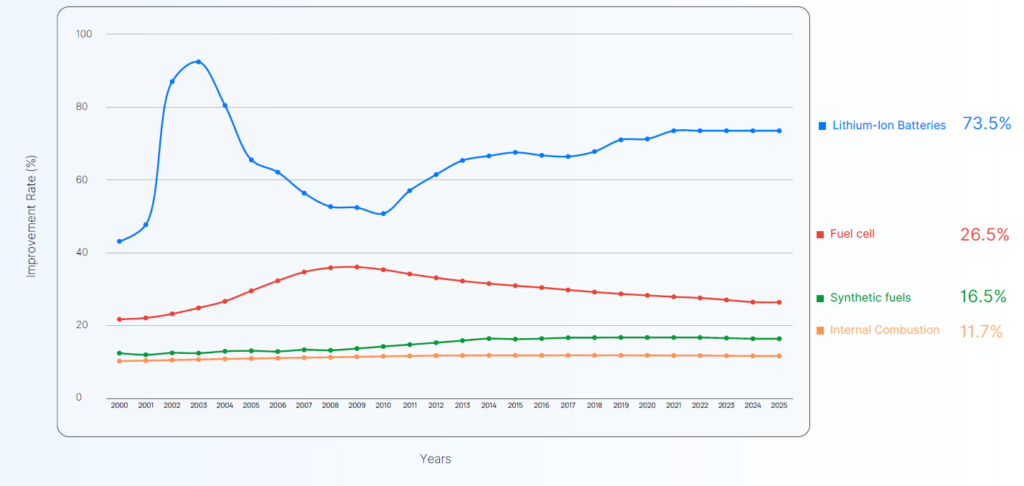

Europe’s automotive industry faces a critical juncture in the electric vehicle (EV) race, lagging significantly behind U.S. pioneer Tesla and China’s BYD. A strategic overhaul is urgently needed to regain competitiveness, as a decade-long delay in adopting lithium-ion battery technology and misdirected investments in alternative fuels have created a substantial technological and market share deficit.

In the early 2000s, European automakers explored hydrogen fuel cells, biofuels, and compressed natural gas (CNG), while Tesla and BYD focused on battery-electric vehicles (BEVs). This divergence resulted in a critical delay in lithium-ion development. Companies like BMW and Daimler invested heavily in hydrogen fuel cell prototypes and gas-powered alternatives, squandering valuable time. While the U.S. and China invested in EV R&D with lithium-ion technology, Europe was stuck in R&D cul-de-sacs.

The Impact of Delayed Scaling, Investment, and Technological Momentum

By the time European manufacturers introduced their first new-generation BEVs in 2012-2013, Tesla and BYD had already established mass production capabilities. Furthermore, Europe failed to scale its investments in lithium-ion and gigafactories at a pace comparable to its competitors, prioritizing hybrids and combustion engines. This delayed scaling resulted in Europe lagging behind in battery production scale, energy efficiency, and cost reduction, exacerbating the competitive gap. The cultural and technological momentum shifted outside Europe.

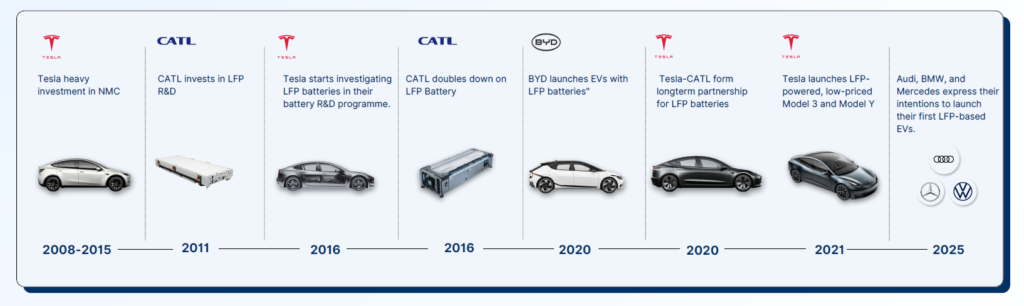

The LFP Battery Chemistry Shift and Europe’s Late Recognition

The industry’s shift towards Lithium Iron Phosphate (LFP) batteries further highlighted Europe’s late recognition of critical trends. While European manufacturers focused on high-nickel chemistries (NMC, NCA) to maximize energy density, Chinese and U.S. players scaled LFP, prioritizing lower costs, improved safety, and a more secure supply chain. By 2021, Tesla had transitioned its Model 3 and Model Y to LFP, while European automakers only announced their first LFP-based EVs for 2025—nearly 15 years behind China’s large-scale adoption.

The signs of LFP’s rise, evident as early as the mid-2000s, were overlooked. LFP’s improvement rate had already surpassed NMC’s, showing that it could close the energy gap while remaining cheaper, safer, and longer-lasting. Battery suppliers like CATL and BYD began investing heavily in LFP in the early 2010s, recognizing its long-term advantages.

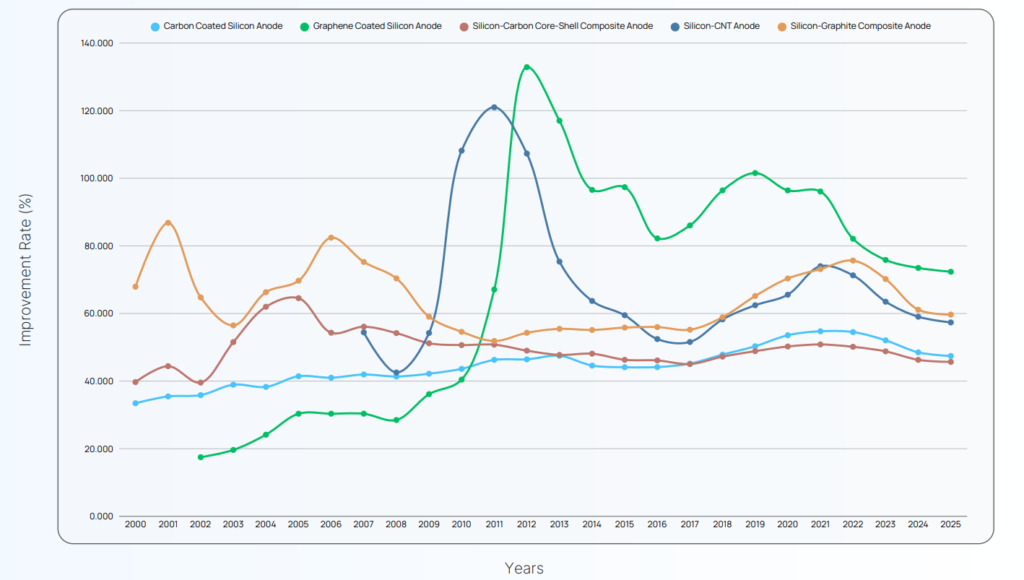

The Next Frontier: Silicon-Based Anodes and Graphene-Coated Technology

Looking ahead, silicon-based anodes, particularly graphene-coated silicon, are identified as the next critical area of battery technology development. Graphene-coated silicon anodes, with their high conductivity, better mechanical stability, and significantly longer cycle life, are emerging as the front-runner, offering a 72% Technology Improvement Rate (TIR). Combining these anodes with LFP chemistry could enable European automakers to bridge the energy density gap while maintaining cost-effectiveness and safety.

Europe’s Strategic Action Plan for Recovery

To reclaim its position in the global EV industry, Europe must:

- Accelerate LFP Battery Production: Establish a robust local LFP battery supply chain to reduce costs and enhance BEV affordability.

- Invest Heavily in Silicon-Based Anode R&D: Prioritize research and development in silicon-based anode technology, particularly graphene-coated silicon.

- Utilize AI-Driven Technology Forecasting: Employ platforms like GetFocus to gain critical insights into emerging technologies and anticipate market shifts.

- Secure Supply Chains & Reduce Dependency: Build domestic gigafactories and forge raw material partnerships to reduce reliance on external battery suppliers.

- Leverage AI for Energy Optimization: Improve EV efficiency through advanced battery management software to differentiate beyond hardware improvements.

A Call to Immediate Action

The window of opportunity is closing. Europe’s delayed commitment to lithium-ion technology has resulted in a significant competitive disadvantage. However, the next phase of battery evolution, centered on silicon-based anodes, AI-driven optimization, and localized LFP production, presents a chance for recovery. European automakers and policymakers are urged to swiftly implement the outlined strategies to reclaim their position in the global EV market.